Our acquirer-first platform includes:

White Labeled PCI Program

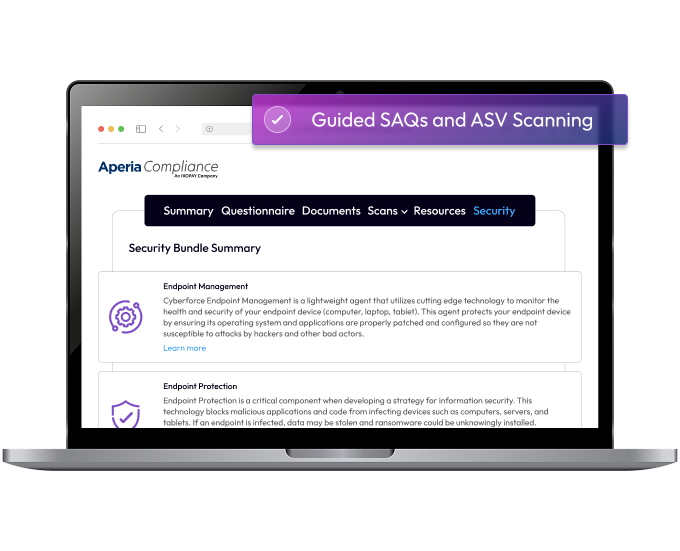

Fully branded portals, SAQ logic, ASV scans, tracking, reminders — all merchant-facing PCI tasks handled for you.

Includes Compliance Center support, no development lift required!

Website & Privacy Compliance

ADA, GDPR, age gating, policy creation, and global privacy monitoring tools that drive merchant stickiness and revenue, while helping reduce reputational and legal risk.

Script Monitor

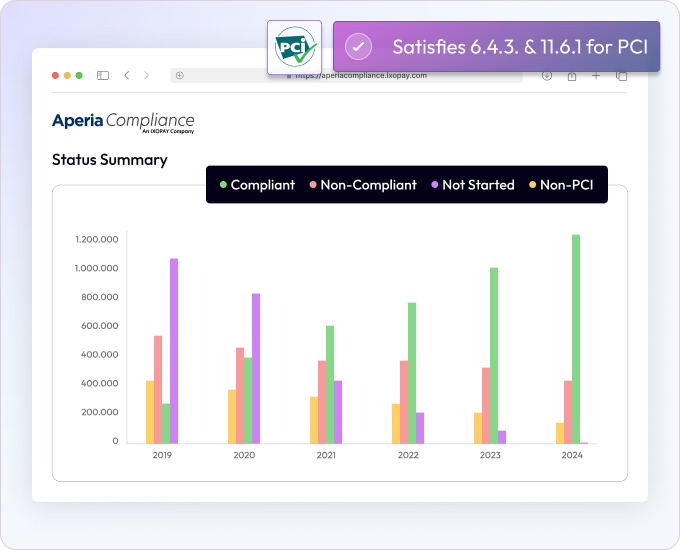

Detect and block unauthorized or malicious scripts. Required under PCI DSS 4.0.1 and 6.4.3 & 11.6.1.

Endpoint Protection & Breach Resolution

Block malware and vulnerabilities with real-time patching, and support merchants after incidents with breach response and card-testing reimbursement to help absorb financial and operational impact from high-volume authorization attacks.

How Aperia Compliance

Helps You Drive Revenue

Reduce Churn: Proactive outreach, merchant-first support, and simple workflows help merchants stay compliant — and stay longer.

Monetize Compliance: PCI, privacy, and security add-ons give you new revenue levers within your existing portfolios.

Increase LTV: Merchants who complete PCI stay longer and trust your platform more, driving stronger lifetime value.

Zero Support Drain: Offload merchant support, outreach, and SAQ logic with no dev work on your side — freeing your team to focus on growth.

Why Acquirers Choose

Aperia Compliance

U.S.-based support team, serving merchants globally in multiple languages

Proven to increase merchant retention and drive downstream revenue

Designed to improve portfolio resilience and long-term merchant value

Get a fully whitelabeled PCI platform, no development required

Offload merchant support & SAQ assistance

Track compliance across all portfolios

Comply with current and future card brand mandates